Financial planning is often required to invest in higher education, where students’ loans are an important component for more. Understanding debt types, conditions and repayment strategies is important for creating alternatives that support long-term economic health. With careful research and preparation, students can control their educational debt with confidence.

Understanding Federal Student Loans

Federal loans introduced by the US education department are a primary alternative for most students because of their fixed interest rates and flexible words. Directly subsidised loans, depending on the financial requirement, do not earn interest at school, while direct members who are available for all begin to earn interest immediately. Parents Plus loans allow parents to borrow for their children but have high prices. Federal loans also provide benefits such as income-driven repayment and potential forgiveness programmes, making them attractive.

Exploring Private Student Loans

Private loans provided by banks or credit associations can complement the federal assistance. They often have convertible interest and require credit checks or co-signers. Being useful for filling financing intervals, private loans lack federal security such as decimation or prohibition. It is necessary to compare lenders and words carefully to avoid unfavourable conditions and to ensure manageable refunds.

Borrowing Wisely

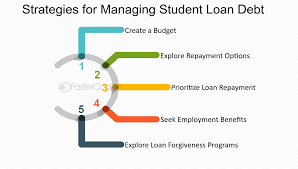

To reduce the loan, students should only borrow what is necessary. Searching for scholarships, grants or working time can reduce debt dependence. Creating a budget and assessing future earnings helps prevent overdrilling. By coordinating loans with financial realities, students can establish themselves to succeed after graduation.

Planning for Repayment

It is important to understand the option for a refund for a long-term plan. Federal loans offer schemes by default, confirmation or income-driven, which adjust payment based on income. Private loans can have fewer alternatives, so it is important to review conditions. Preparation of repayment quickly ensures a steady transition after graduation.

Resources for Guidance

For more insights on managing educational debt, tools like College Ave’s student loan insights offer valuable support. By researching thoroughly and planning strategically, students can secure funding while keeping financial stress in check, paving the way for a brighter future.